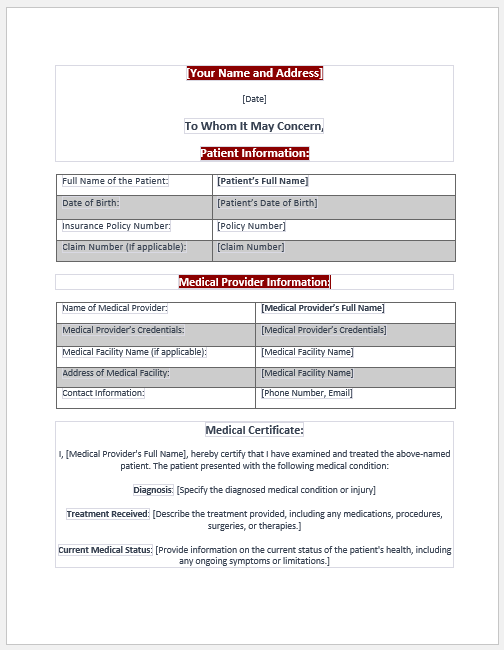

A medical certificate for an insurance claim is an official document that serves as evidence of the ill health diagnosis or treatment of an individual. These certificates are issued by certified medical professionals working at verified healthcare facilities to ensure the authenticity of the insurance claim. These certificates are used to seek health insurance claims based on poor health or major treatments.

Insurance regarding health and travel can be obtained by submitting evidence in favor of the above-mentioned tasks. These certificates are proofs and assist individuals in seeking the best deal they can get. Health insurance covers all medical expenses, treatments, diagnoses, surgeries, and medication. Travel insurance is employed during travel and takes care of all the issues that may occur while traveling and staying.

Medical conditions of illness, injury, or inability can be used for filing insurance claims. It usually signifies that an individual is unable to perform at a place of employment and does not have enough funds to seek medical treatment; therefore, he should be awarded insurance. Similarly, during travel, insurance companies take care of all the expenses in case of emergencies because foreign medical treatment can be very expensive, and assistance from insurance can help reduce it.

The certificate contains various information

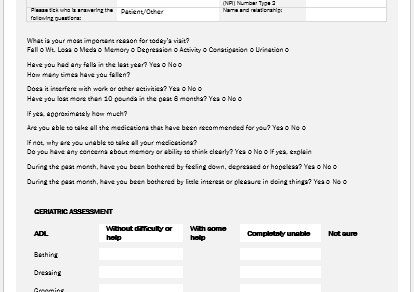

The major elements of a medical certificate for insurance claims include:

- Patient’s information: The name, date of birth, gender, national identification, contact information, and address of the patient or concerned individual are provided on the medical certificate.

- Medical professional information: The name and contact of the doctor, along with the name, address, and contact of the healthcare facility, are mentioned in detail to verify the medical certificate.

- Vitals: weight, height, blood group, respiratory rate, oxygen level, blood work, and all other essential vitals of the patient are assessed and mentioned in the certificate.

- Assessment: After a complete diagnosis, the healthcare provider assesses the condition of the patient and makes notes for the certificate.

- Signature: at the end, medical certificates are signed off by a healthcare professional as well as the administrator of the healthcare facility.

What purpose(s) can the certificate serve?

A medical certificate can be used for many purposes, but for insurance claims, it is used for the following reasons:

- Verification: medical certificates are used for verification of the information provided by the individual to claim insurance.

- Medical check: medical certifications are awarded after a complete medical checkup; therefore, these certificates can be used to explain the medical condition of the individual for claiming health insurance.

- Reimbursement: A medical certificate is also submitted with the reimbursement application to receive the funds that have been used for a medical emergency.

- Travel: Travel insurance also requires a medical certificate to ensure that a person is physically fit before embarking on a journey, and any mishap that occurs while traveling would be an incident.

The importance of using the certificate

There are significant benefits to medical certificates acquired for insurance claims; some of these are given as follows:

- It helps individuals acquire proof of their medically unfit condition, and they can be compensated for it.

- Based on the medical certificates, insurance companies assess the extent of the situation and the compensation awarded for it.

- Many insurance companies limit individuals to acquiring certificates from renowned healthcare facilities to keep the process clear and free of doubts.

Sample Certificate File

Size: 145 KB

File pages = 2

Medical certificates for insurance claims have been on the market for a long time because of the information they provide. These certificates help both parties seek valid data that can be corroborated without any issues. Since medical certificates are submitted with an insurance application, insurance companies can verify the medical condition of an individual by matching them with their previous medical history or by contacting a healthcare professional who assessed the individual during the checkup.

Hundreds of insurance claims are filed each day, but only a few get approved due to a lack of supporting data. Insurance companies are bound to do their due diligence before handing out money to make sure that people are not lying and creating false documents. To avoid these issues, policyholders are advised to submit multiple authentic documents supporting their claim; otherwise, they will be rejected by the company.

Moreover, the information provided on a medical certificate has legal weight because it describes the assessment of a medical professional, and falsifying such a document can cause legal troubles. Therefore, it is advised to generate a legal medical certificate of illness or injury because it is crucial for filing an insurance claim.

- Nursing Documentation Templates

- Mental Health Evaluation Forms

- Forms Used by Pediatricians

- Various Forms Related to Pregnancy Verification

- Common Forms Used by ENT Specialists

- Pain Diary Worksheet Template

- Forms Commonly Used by Old Age Homes

- Medical Treatment Consent Form

- Home Exercise Program Worksheet

- Forms Used for Mental Health Assessment

- Forms Used by Psychologists

- Medical Forms Commonly Used by/for Students

- Assessment Consent Form

- Forms Used by an Anesthesiologist

- Not Fit to Fly Certificate Template

- Home Visit Consent Form for Schools

- Important Forms Commonly Used by Pharmacies

- Important Forms Commonly Used by Dentists

- Forms used in Disease Testing or Diagnostic Laboratories

- Prescription Pad Templates

- Medical Certificate for School Leave