People often purchase insurance policies to receive partial or full coverage for their medical expenses. When they seek medical treatment at a hospital, they inform the hospital that they have an insurance policy through which they can claim reimbursement or direct coverage for their expenses.

When this occurs, healthcare practitioners confirm that the patient receiving treatment is eligible to apply for an insurance claim. To do so, they verify the patient’s insurance coverage.

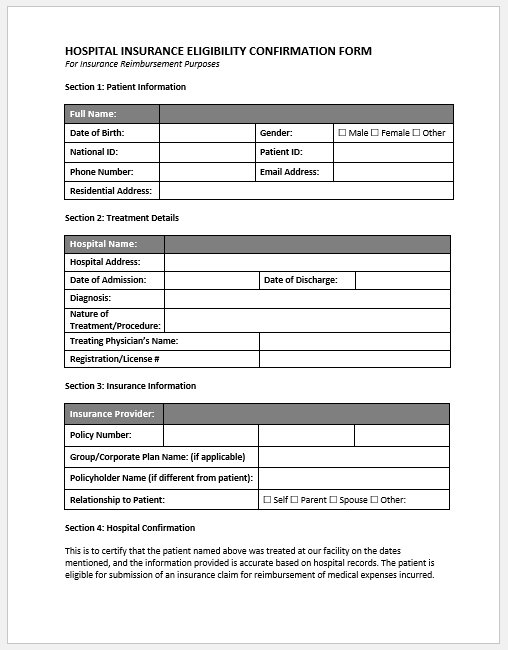

To ensure a smooth verification process, various tools are used. Most hospitals rely on an insurance verification form, which not only facilitates the verification itself but also serves as a useful reference for retrieving other patient details in the future.

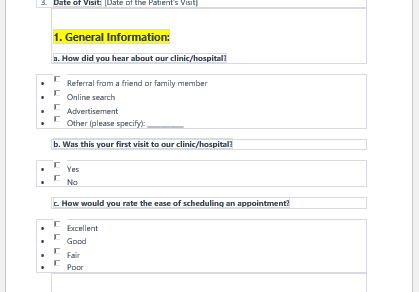

What is an insurance confirmation form?

It is a tool used by hospitals to confirm that the person applying for insurance coverage is eligible to receive it. When a patient receives treatment from a healthcare facility, they may need to request reimbursement for the medical expenses incurred.

What is the purpose of the insurance confirmation form?

When a person receiving treatment at a hospital clearly states that they are unable to cover their medical expenses and will rely on an insurance policy they have already purchased, the hospital is responsible for verifying whether the patient’s claim is valid and can be accepted by the insurance provider.

Insurance Coverage Verification Process

The healthcare facility is unable to cover the cost of the patient’s treatment and, therefore, verifies whether the insurance coverage is still valid and authentic. In some cases, the hospital also uses this form to determine whether the insurance company will accept or reject the claim. If the claim is rejected, the hospital will not proceed with the treatment, and the patient will be responsible for covering the medical expenses.

Purpose of the Insurance Declaration Form

This form is used when a patient informs the hospital that they have an active insurance policy and intend to have their medical expenses reimbursed. However, since hospitals cannot rely solely on the patient’s verbal assurance, they use this form to collect detailed information about the insurance policy. This allows the hospital to verify the coverage directly with the insurance provider.

This form helps a healthcare facility collect accurate and up-to-date information about the patient’s insurance policy. It allows the institution to verify whether the policy has expired and to check whether any previous claims have been rejected. If so, it can also determine the reasons for those rejections.

This form can also be used to verify the authenticity of an insurance policy. Based on the information provided by the patient, the hospital can contact the insurance company to confirm the details and ensure the policy is valid.

What information is collected by the confirmation form for insurance?

The main information that this form collects is:

Details of the patent:

The patient is required to provide personal information, such as name, date of birth, Social Security number, patient ID, contact details, and other relevant information.

Details of the insurance policy:

The form also collects information about the insurance company, including the company’s name, the type of policy, a unique policy number, the total premium paid by the patient, the total claimable amount, and other relevant details.

Consent of the patient:

The form also requires the patient to read the consent clause to understand the type of consent being requested, after which they are asked to sign the form. This document becomes an essential part of the hospital’s records, as it serves as proof of consent obtained from the patient or their caregiver. It can help protect the hospital from potential legal complications that may arise in the future related to consent.

A healthcare institution should use a verification form to streamline and simplify the billing process. It becomes easier for the hospital to collect payment for treatment when it is clear whether the payment will be made by the patient or covered by the insurance company.

Template File Format: MS Word

- Nursing Documentation Templates

- Mental Health Evaluation Forms

- Forms Used by Pediatricians

- Various Forms Related to Pregnancy Verification

- Common Forms Used by ENT Specialists

- Pain Diary Worksheet Template

- Forms Commonly Used by Old Age Homes

- Medical Treatment Consent Form

- Home Exercise Program Worksheet

- Forms Used for Mental Health Assessment

- Forms Used by Psychologists

- Medical Forms Commonly Used by/for Students